UPI- The unified payments interface (UPI) is an instant payments system developed by National Payments Corporation of India (NPCI) . It is used on mobile devices to instantly transfer funds between two Bank accounts. the mobile number of the device has to be registered with the bank account. you can send or receive money or scan a quick response (QR) code to pay an individual, a merchant or a service provider to shop, pay bills or authorize payments.

To enable payment using your phone, all you need is a mobile payment application and the virtual address of the payee. This implies you can make payments directly to the accounts of a vendor or a person, in one step. There is no repetitive step involved. For example, entering bank details or other sensitive information each time you need to make a payment.

It is easy, free of charge and instantaneous. UPI allows you to make transactions 24/7, throughout the year. Currently, one can transfer up to INR 1 lakh in a single UPI transaction.

UPI was launched in 2016, is the brainchild of the National Payments Corporation of India (NPCI), the umbrella organization that oversees retail payment systems in India. The NPCI is governed by the central banking authority, the Reserve Bank of India, and its primary goal is to drive India towards becoming a digital economy.

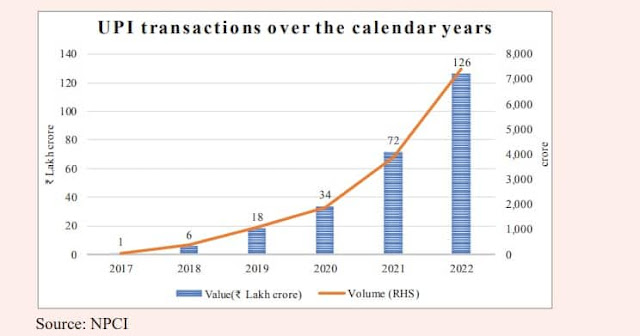

UPI Transactions over the calendar years and year by year setting a record.

The volume of the UPI transaction increased by 62 per cent from 31.95 billion in the first half of 2022 to 51.91 billion in the first half of 2023. as per the reports Person-to-Merchant (P2M) transactions rose from 40.3 percent in January 2022 to 57.5 per cent in June 2023.

The Average Ticket Size (ATS) for UPI P2M transactions saw a decline from Rs 885 in January 2022 to Rs 653 in June 2023, reflecting the increasing use of UPI for micro transactions. Says Ramesh Narasimhan CEO of Worldline India, said, that the first half of 2023 witnessed “an impressive performance of UPI, the surge in credit card usage, the jump in mobile payments volume, and the uptick in small ticket size P2M transactions.”

The report anticipates a substantial increase in transaction volume and value with the introduction of credit card transactions on UPI and UPI Lite. Additionally, the RBI's announcement of pre-sanctioned credit lines on UPI is expected to benefit merchants, providing them with instant access to credit.

Digital India :

Last few years have seen a technological revolution in governance in India. Government services have been slowly and steadily brought on board and today, last-mile delivery happens with the click of a mouse in seconds. Digital Payments transactions have been increasing over the last few years, as a part of the Government of India’s strategy to digitize the financial sector and economy. Further, concerted efforts have been made to promote financial inclusion as one of the important national objectives of the country.

The key enabler at the Centre of India’s transformed digital payment landscape is the JAM Trinity - Jan Dhan, Aadhaar and Mobile. Pradhan Mantri Jan-Dhan Yojana is one of the biggest financial inclusion initiatives in the world, launched in August 2014, to provide universal banking services for every unbanked household. Aadhaar, the Unique Identification Authority of India’s flagship product, is a simple but effective method to verify individuals and beneficiaries based on their biometric information. Jan Dhan accounts, Aadhaar and Mobile connections, taken together, have helped lay the foundations of a Digital India where a vast array of Government services are made available directly to the citizen with enhanced ease of access without the presence of any intermediary .

Digital Payment Ecosystem in India:

One of the major objectives of Digital India is to achieve “Faceless, Paperless, Cashless” status. The promotion of digital payments has been accorded the highest priority by the Government of India to bring each and every segment of our country under the formal fold of digital payment services. The vision is to provide the facility of seamless digital payment to all citizens of India in a convenient, easy, affordable, quick and secured manner.

During the last three years, digital payment transactions have registered unprecedented growth in India. Easy and convenient modes of digital payment, such as Bharat Interface for Money-Unified Payments Interface (BHIM-UPI); Immediate Payment Service (IMPS); pre-paid payment instruments (PPIs) and National Electronic Toll Collection (NETC) system have registered substantial growth and have transformed digital payment ecosystem by increasing Person-to-Person (P2P) as well as Person-to-Merchant (P2M) payments. At the same time, pre-existing payment modes such as debit cards, credit cards, National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) have also grown at a fast pace. BHIM-UPI has emerged as the preferred payment mode of users. The Government of India also launched the digital payment solution e-RUPI, a cashless and contactless instrument for digital payment which is expected to play a huge role in making Direct Benefit Transfer (DBT) more effective in digital transactions in the country. All these facilities together have created a robust ecosystem for a digital finance economy.

Comments

Post a Comment